With the energy transition producing startups and driving existing firms to expand into new markets, well-defined middle and risk office roles are vital: helping evolving commodities organisations meet increasing complex business and regulatory requirements.

However, too often across the sector, these critical roles are merged or developed ad hoc. In this article, energy trading risk specialist Brian Rusch argues that formalising these roles is essential for creating the solid foundation firms need to ensure they can fully capitalise on trading opportunities.

Brian has spent nearly two decades working in risk management functions in energy and commodities, in roles including Head of Risk Management at Litasco Middle East and Wellbred. He recently joined Nuvo Energy as COO.

The Talent Challenge

With significant shifts in the global energy and commodities landscape, risk and middle office functions have seldom been more vital. However, I have seen how they can often overlap at multiple stages throughout the trade life cycle. In many organisations, a typical role prioritises the middle office function while risk management is simply addressed on an ad-hoc basis.

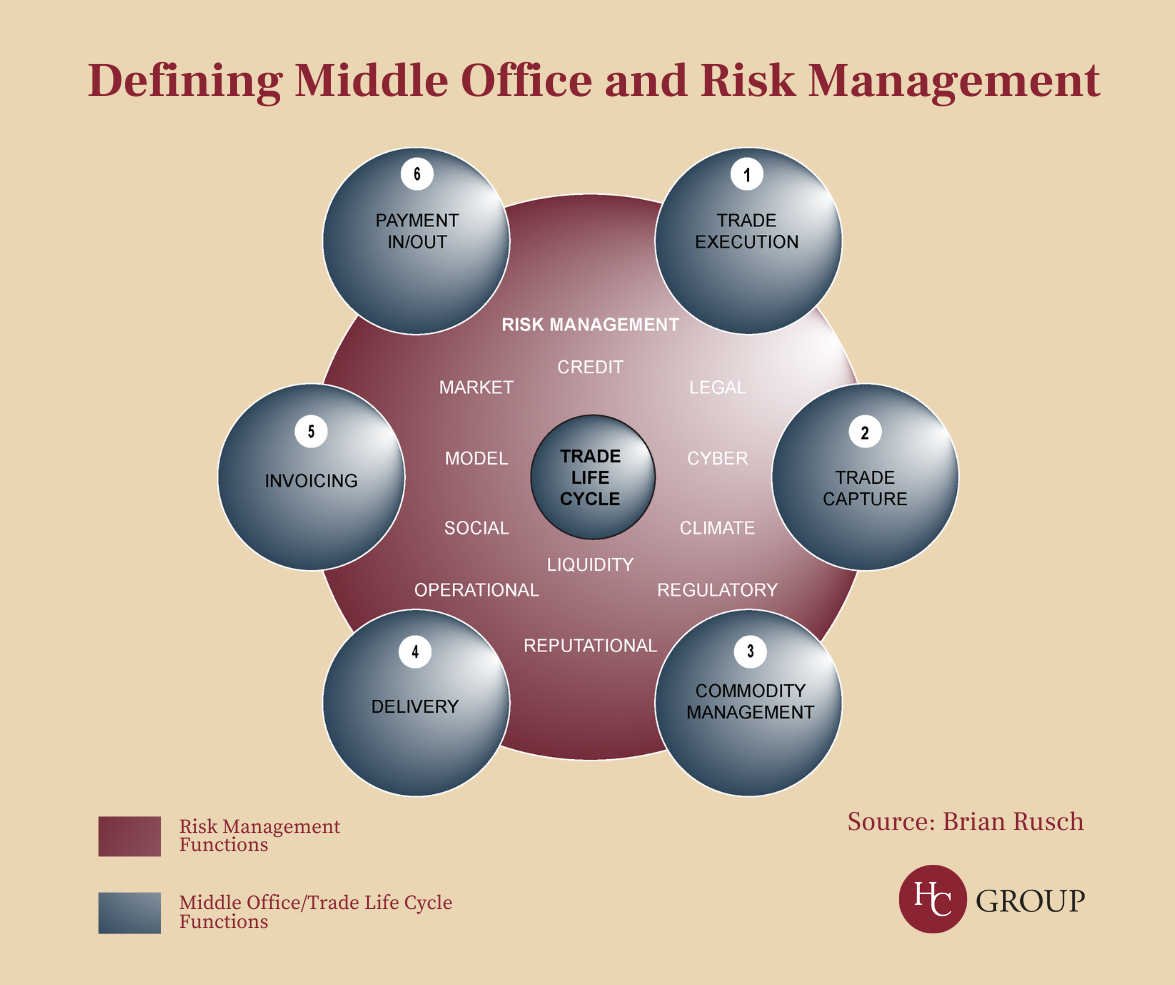

To go back to basics, middle office and risk tasks are part of the initial stages of the trade life cycle and collaborate closely with all departments. Startups and expanding firms need the middle office and risk to drive, coordinate and own the trade life cycle. Proper CTRM implementation, price feeds, clearing capabilities, digitalised reporting and risk frameworks are all foundations needed for a successful future.

However, building this vital foundation requires the right talent, which can be challenging as many firms don’t provide a career path on exactly what a middle office and risk career looks like. On one hand, candidates and existing employees often view the role as an entry into the commodity trading industry with high aspirations to become a trader. Meanwhile, firms frequently expect the risk and middle office to be independent, with a clear segregation of duties to comply with bank and auditing requirements.

True, independence is needed to ensure integrity. But it also creates a silo for employees. This can make them feel isolated from the rest of the firm due to the policing nature of the risk control function.

Discover risk and middle office talent solutions.

HC Group supports energy and commodities organisations to solve talent challenges across corporate functions.

Defining Roles

One key solution is for firms to more clearly define their middle office and risk roles. This can help build a solid team, giving transparency to other departments and developing an active firm-wide career plan. Clearer definitions can also help ensure employees grow to their potential and want to stay in a firm for the long-term.

In terms of middle office roles, they should focus on the daily execution of the trade life cycle. In practice this means work including deal entry-amendments; hedge allocations; exposure management; economics checks; reconciliations; and PnL explained. This role can also be divided into junior, mid and senior categories.

The risk role, on the other hand, needs to focus on risk frameworks; monitoring; controlling; and advising on mitigation plans along the trade life cycle. Additionally, it should advise on overall business strategy by giving an independent risk-reward assessment. It should also require candidates to have a good working knowledge of the trade life cycle as well as the middle office role.

In terms of middle office roles, they should focus on the daily execution of the trade life cycle

Aligning Experience

The range of knowledge and experience required to perform the risk role well means it’s not ideal for junior level individuals - unless the person is supported by a large, specialised team. In general, the risk role needs to complement the trade life cycle to ensure that the process is controlled and have a direct line to upper management and boards to raise concerns and issues where needed.

Middle office tasks, meanwhile, can sometimes be tedious - which can lead to errors if the person hired for the role is not suitable for this kind of work. Additionally, the wrong skillset and experience can lead to processes being rushed, or non-streamlined implementation of new business.

In the best scenario, middle officers are well-matched with the work, and know they have support from the risk role where needed. This ensures controls are in place and that middle office has a channel into upper management when they need to raise concerns.

Advice for Managers

Defining these roles makes for a more transparent and robust trade life cycle process. The challenge is to strike the right balance over how to distribute the roles among employees and not create silos.

Ideally individuals should have awareness of both roles. Junior candidates should start with more weight on middle office tasks; as they learn and develop their potential, they should grow into the risk role. Having clearly defined roles and career paths as part of an active firm-wide career plan can also promote cross-department moves – which, in turn, fosters greater collaboration across firms.

The risk role needs to focus on risk frameworks; monitoring; controlling; and advising on mitigation plans

For hiring managers, finding the right candidates for middle office and risk is often challenging. Retaining those candidates can be even more difficult. Having well-defined roles at different experience levels can really help managers build and envision their department framework. Firm-supported career plans will give managers the leverage they need to guide employees on their career paths and ensure they can retain them, so they stay loyal in difficult times.

Guide For Candidates

Candidates seeking careers in commodity trading are usually eager to learn and grow. Middle office and risk role are great entry points to start that career.

However, the most successful candidates take time to see how the two roles are broken down into daily tasks. The best also understand where they can prosper with their current skills and when to grow by learning new ones. This can also help rising talent in their expectation management around when to expect promotions - and how to reach them.

Overall, the energy transition is making an already fast-paced industry even more exciting to work for. Now is the time for firms to invest and build a truly solid foundation for their middle and risk officers’ careers, in order to attract and retain the most driven employees.

Putting in place the right frameworks now will enable both companies and employees to both seize the trading opportunities that are currently developing, and to prepare the ground for future ones.

HC Group has more than two decades of experience in placing a wide variety of risk management and middle office leaders across energy and commodities.

Connect with our specialist talent consultant to learn more: Igla Lici, Senior Associate, Corporate Functions.