Each month, HC Group's Talent Intelligence Team will bring you an expert view of the human capital landscape in commodity trading. Drawing on HC Group's unique position as global search specialists in energy and commodities markets, we will decode the trends that are shaping talent strategies across the industry.

In this edition, Shanez Fernando cuts through the rhetoric to examine what's actually changing for women in commodity trading careers, where representation is improving, where the bottlenecks persist, and why some roles are evolving faster than others.

HC Talent Intelligence provides tailored talent data insights for clients across global energy and commodities markets.

1. Positive Steps vs the Pipeline Problem

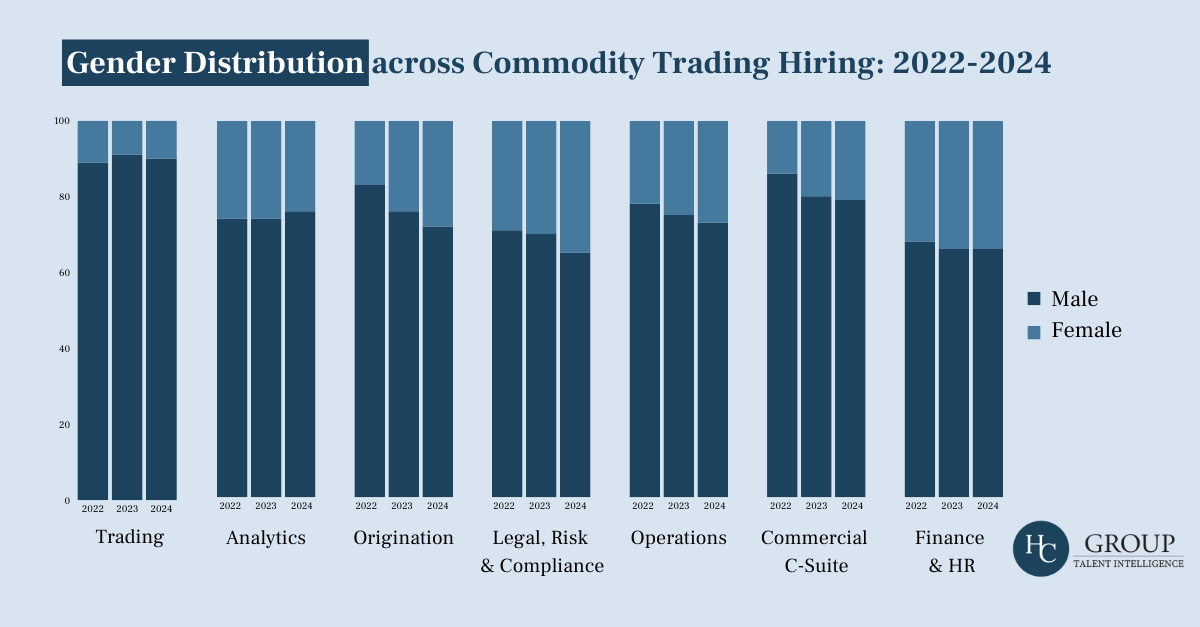

Chart 1 is a comparative gender analysis of commodity market moves over the last three years, that unveils positive incremental changes across several roles. Middle and back-office functions display the highest levels of gender balance, with women making up 35% of overall market moves into Legal, Risk & Compliance.

Research has shown that in 2018, less than 5% of senior leadership positions in commodity trading were held by women. Six years on, HC Group has found that women now account for over 20% of Commercial C-Suite market moves, signalling a positive trajectory for the industry. Moreover, female representation now makes up nearly 30% of all origination market moves in 2024, a 14% increase from 2022.

Despite these positive increments, the overall picture is far from equal. Hiring female senior leaders uncovers the inherent “pipeline problem”, where the speed for women to progress in seniority is slower than their male counterparts. Female representation in Analytics has decreased marginally, and gender inequality in trading is still critically high, with little to no improvement in recent years, as women account for around 10-12% of total hires.

Register for Our Global Energy Trading Compensation Report 2024/25

Register by February 28th for a 10% discount. Complete our compensation survey for a 20% discount. Release date: April 2025.

2. Pathways to New Trading Careers

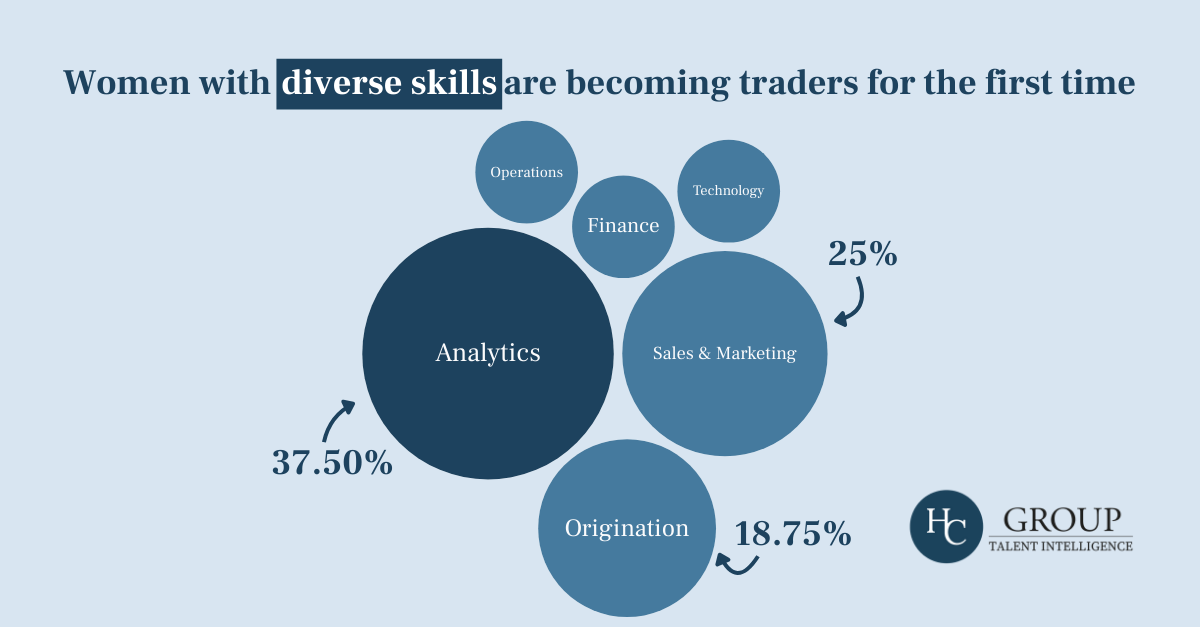

The landscape of women's career transitions in trading during 2024 reflected a notable shift, with professionals from diverse backgrounds, including technology, legal, and finance, moving into trading roles.

An analysis of career movements (Chart 2) has revealed that among the transitions into trading, analytics emerged as a dominant talent pool, accounting for 37.5% of moves. Sales and marketing followed as the second most common path, representing 25%, while origination constituted 18.75% of the transitions. The remaining moves were evenly distributed across technology, operations, and finance & HR.

This distribution suggests a growing diversification of career paths for women in the trading sector, with data-driven expertise, physical operations experience, and commercial acumen from sales roles emerging as key drivers of change. Notably, these pathways are proving particularly effective in bringing more women from support functions into revenue-generating trading positions.

Included in our Global Energy Trading Compensation Report 2024/2025

- 200+ Trading Positions Analysed

- Global Coverage Across Key Regions

- Complete Energy Markets Coverage

- Latest Market Intelligence

For more information contact intelligence@hcgroup.global

3. Where Do We Go From Here?

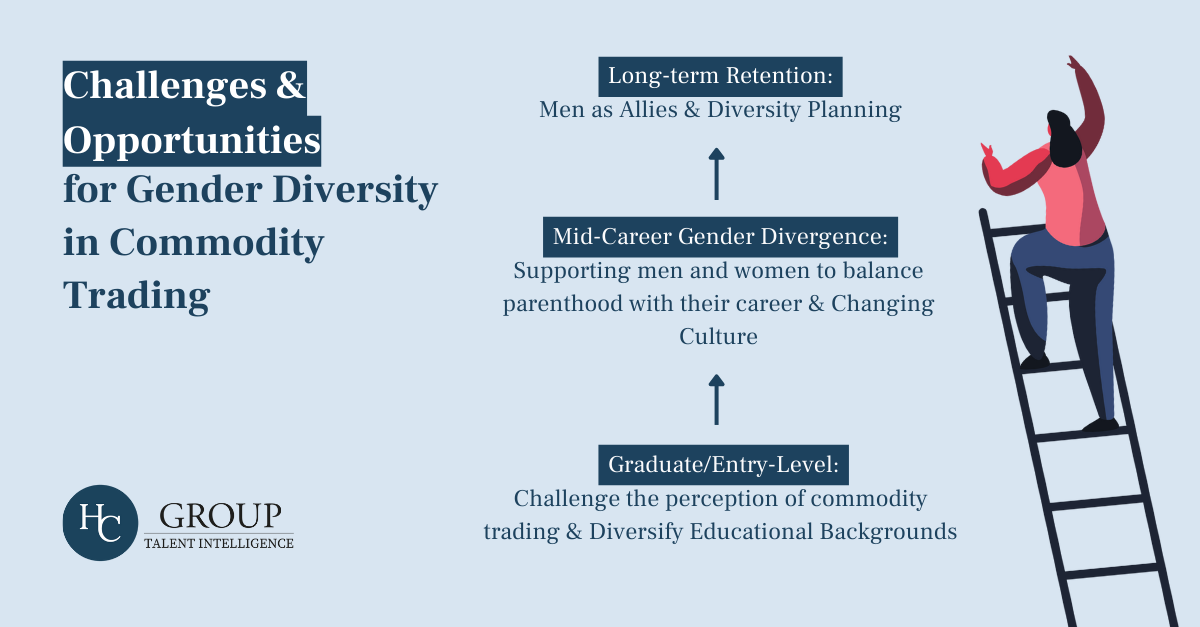

Current data demonstrates systematic barriers to gender equality exist across all seniority levels in commodity trading. Analysis of graduate recruitment patterns reveals two primary challenges: industry perception and purpose alignment. The sector's reputation, combined with increasing environmental and ethical concerns among graduates, continues to impact recruitment effectiveness.

Entry-level recruitment data highlights untapped potential in non-traditional talent pools. By expanding beyond economics and mathematics backgrounds, organisations can access candidates whose soft skills and diverse perspectives often prove valuable in trading roles. This approach aligns with our analysis of successful female traders' backgrounds, where diverse experience across analytics, sales, marketing, and origination has proven beneficial.

Retention metrics highlight the critical impact of the "motherhood penalty," with career trajectories typically diverging between male and female traders during key family formation years. While flexible work policies show promise in addressing this challenge, their effectiveness depends heavily on cultural implementation and leadership support.

The progress in commercial C-suite representation, witnessed in Part 1, demonstrates positive momentum. However, with trading roles still showing only 10-12% female representation, and analytics showing similar stagnation, the data indicates significant work remains to achieve gender parity. Organisations that prioritise male allyship in DE&I initiatives consistently show stronger progress, suggesting this should be a key metric in diversity strategy implementation.

Thank you for reading this analysis from our Talent Intelligence Team.

To get more charts and insights delivered direct to your inbox, why not sign up to HC Group's Talent Intelligence Newsletter.