Today's energy trading landscape is more dynamic then ever. Q1 2025 also brought challenges and opportunities including policy uncertainty and the development of lower-cost AI.

HC Group's Q1 Market Review explores what these trends mean for talent, impacting both companies and candidates alike across global energy and commodity markets. The review includes more than 400 People Moves - our well-known guide to the notable individuals switching roles in Q1.

Read on for a preview of what to expect inside this latest edition.

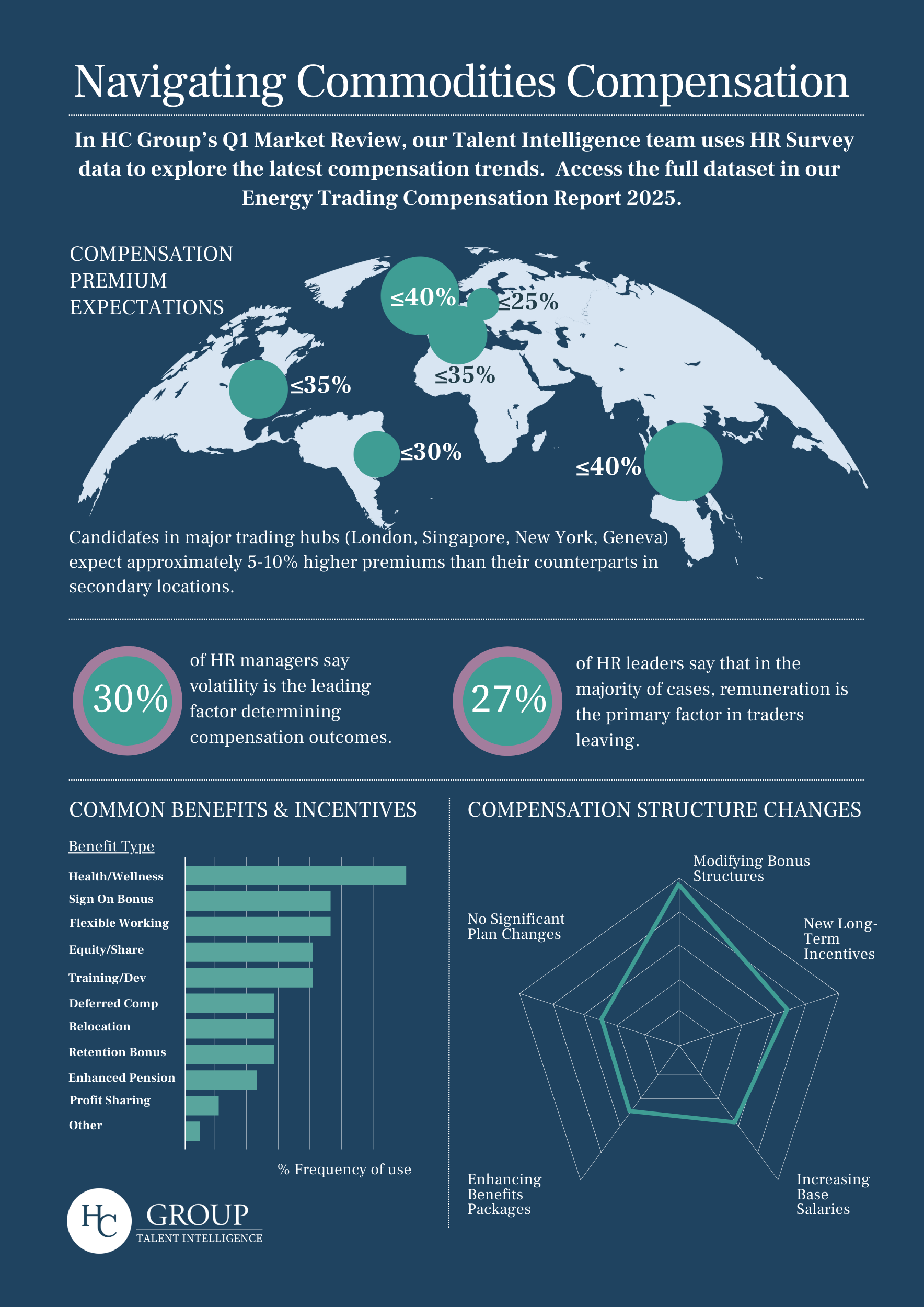

In Focus: Commodities Compensation Data

Bonus levels have moderated from recent peaks, although they still remain historically high compared with pre-pandemic benchmarks. While overall turnover remains moderate, with 59% of companies reporting fewer than 5% staff departures, remuneration has factored significantly in these movements. This creates an opportunity, and a need, to evaluate total reward strategies beyond direct compensation. Here's a preview of our Q1 Market Review talent data visualisation.

Inside the Q1 Market Review

- 400+ notable People Moves in our sector

- The latest compensation trends shaping offers and retention in 2025

- How to balance parenthood and a top trading career - and how commodities companies can help

- Talent insights from our new Industrial & Upstream Practice

- Comprehensive analysis from our talent consultants in LATAM; EMEA, APAC and the Americas; covering major sectors and functions from Metals and Ags to Corporate Functions, Gas and LNG

Transition Shapes Industrial and Upstream Talent Strategies

Amid muted oil and gas markets, firms are targeting technical talent that can improve productivity of existing assets. Meanwhile, AI is reshaping industrial and upstream talent requirements. In our Q1 Market Review, our new Industrial and Upstream talent practice reviews the key skills and career developments in the sector. Here's a preview.

Asset Optimisation in Muted Oil Markets

Record US oil production amid efforts by the new administration to curb inflation contributed to a muted outlook for the sector in Q1. This prompted companies to re-evaluate capital allocation, with new drilling activity under pressure. For technical and industrial talent, this means a focus on operational efficiency, including cost control and asset optimization. As a result, engineers, field technicians, and maintenance specialists who can extend asset life and deliver productivity gains are in demand.

AI Reshapes Technical Talent Requirements

As technology investments accelerate in upstream, power, chemicals, and industrial sectors, demand for AI-skilled technical talent is also rising. Companies are rapidly upskilling and reworking workforce plans to remain competitive. Sought-after roles include engineers, systems integrators, and technicians with expertise in areas including generation, digital controls, energy storage and smart grid technology.