Each month, HC Group's Talent Intelligence Team brings you an expert view of the human capital landscape in commodity trading. Drawing on HC Group's unique position as global search specialists in energy and commodities markets, we will decode the trends that are shaping talent strategies across the industry.

In this edition, we examine the growing gap between established compensation benchmarks and candidate expectations across commodity trading sectors. Our analysis reveals that while candidates seek an average 22% premium when changing roles, this figure varies dramatically by function, commodity class, and geography - creating both challenges and opportunities for organisations and professionals alike.

Register for Our Global Energy Trading Compensation Report 2024/25

Pre-order by March 21st for a 10% discount. Click here to learn more.

Complete our compensation survey for a 20% discount. Release date: April 2025.

1. The 22% Premium: Market Signal or Market Hype?

Our latest analysis of compensation trends in commodity trading reveals a striking pattern: candidates are consistently seeking, on average, a 22% salary increase when exploring new opportunities—despite already earning within established market benchmarks.

Is this simply optimism, or does it signal deeper market shifts? In a year marked by volatility—ranging from price fluctuations to the accelerating energy transition—these elevated salary expectations may be the canary in the coal mine, signalling structural changes in the market rather than widespread under compensation.

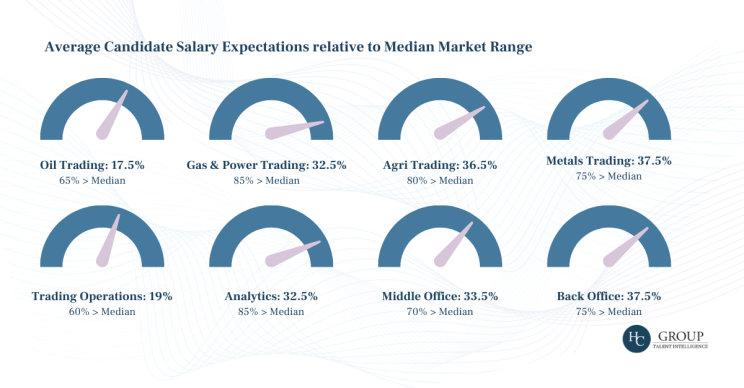

The 22% average masks significant variations across commodity classes that reflect their distinct market dynamics:

Oil Trading professionals demonstrate the most modest expectations (10-25%, averaging 17.5%), with 65% of candidates expecting above-median compensation (chart 1). This modest approach reflects the maturity of oil markets and recent margin pressure facing many traditional trading houses.

Gas & Power candidates show substantially higher expectations (15-50%, averaging 32.5%), with 85% seeking above-median compensation despite lower absolute base salaries. This aggressive positioning aligns with the sector's increased strategic importance amid ongoing energy security concerns and transition priorities.

The agricultural and metals sectors show similarly strong premium expectations (averaging 36.5% and 37.5% respectively), reflecting the significant price volatility and supply chain challenges these sectors have experienced throughout 2024.

These variations track closely with market fundamentals, suggesting candidates are responding to perceived shifts in sector importance rather than pursuing arbitrary increases.

HC Talent Intelligence provides tailored talent data insights for clients across global energy and commodities markets.

Learn more about how we can help

2. Function and Geographic Variations

Market dynamics are driving significant regional and functional differences in compensation expectations.

European Gas & Power trading professionals demonstrate particularly aggressive premium expectations, especially in Germany where energy transformation has created acute talent shortages. This contrasts sharply with the more measured approach in Oil Trading, where London-based professionals typically expect industry norm increases of 10-15%.

Support functions tell an equally revealing story. Technology specialists show premium expectations (25-71%, averaging 32.5%) that rival trading roles, with 85% seeking above-median compensation. This reflects the industry's accelerating digitalisation and increasing competition with technology companies for specialised talent.

Geographic patterns reflect regional market priorities, with European renewable energy specialists commanding the highest premiums, while North American professionals demonstrate more moderate expectations across most commodity classes.

The disconnect between established compensation ranges and candidate expectations creates both challenges and opportunities for market participants. Rather than indicating candidates are broadly underpaid or simply asking too much, this gap suggests a market recalibrating in real time.

Included in our Global Energy Trading Compensation Report 2024/2025

- 200+ Trading Positions Analysed

- Global Coverage Across Key Regions

- Complete Energy Markets Coverage

- Latest Market Intelligence

For more information contact intelligence@hcgroup.global

3. Bridging the Expectation Gap - Strategic Implications

The disconnect between established compensation ranges and candidate expectations creates both challenges and opportunities for market participants. Rather than indicating candidates are broadly underpaid or simply asking too much, this gap suggests a market recalibrating in real time.

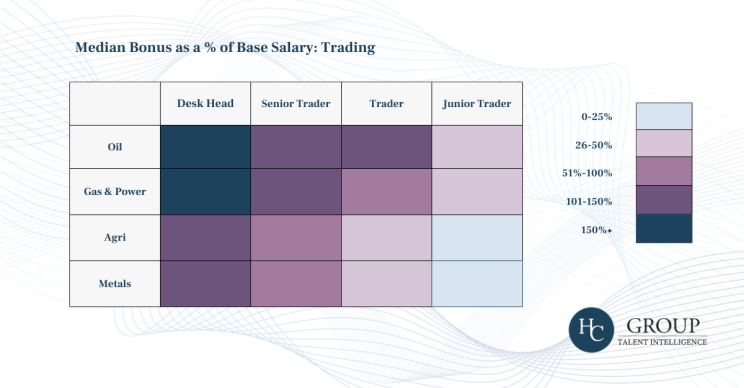

What emerges is a picture of a commodity trading talent market where base salary expectations tell only part of the story. The substantial bonus differentials between sectors and functions reveal the true economics of the industry (chart 3).

Organisations that articulate this complete compensation picture will be better positioned to manage expectations and retain talent in an evolving landscape, while candidates who understand these structural realities can navigate career opportunities more strategically.

Thank you for reading this analysis from our Talent Intelligence Team.

To get more charts and insights delivered direct to your inbox, why not sign up to HC Group's Talent Intelligence Newsletter.