Each month, HC Group's Talent Intelligence Team brings you a data-led view of the human capital landscape in commodity trading, from the latest thinking on succession planning and compensation strategies, to innovative DE&I strategies, talent analytics, and data storytelling.

Here, we focus on the cutting edge of compensation. Explore our charts and analysis to discover some of the hidden and powerful trends that are reshaping the compensation landscape.

These changes are especially significant ahead of crucial bonus announcements in Q1 2025, which will impact people movements and hiring in the coming year.

HC Talent Intelligence provides tailored talent data insights for clients across global energy and commodities markets.

1. Creative Incentive Structures

As energy and natural resources trading experiences unprecedented transformation, traditional trading frameworks are being fundamentally reimagined. At the forefront of this evolution is a decisive shift towards performance-based compensation models.

Driven by these forces, organisations are increasingly moving away from conventional fixed compensation structures. Instead, many are implementing sophisticated frameworks that directly tie trader remuneration to profit generation and risk-adjusted returns.

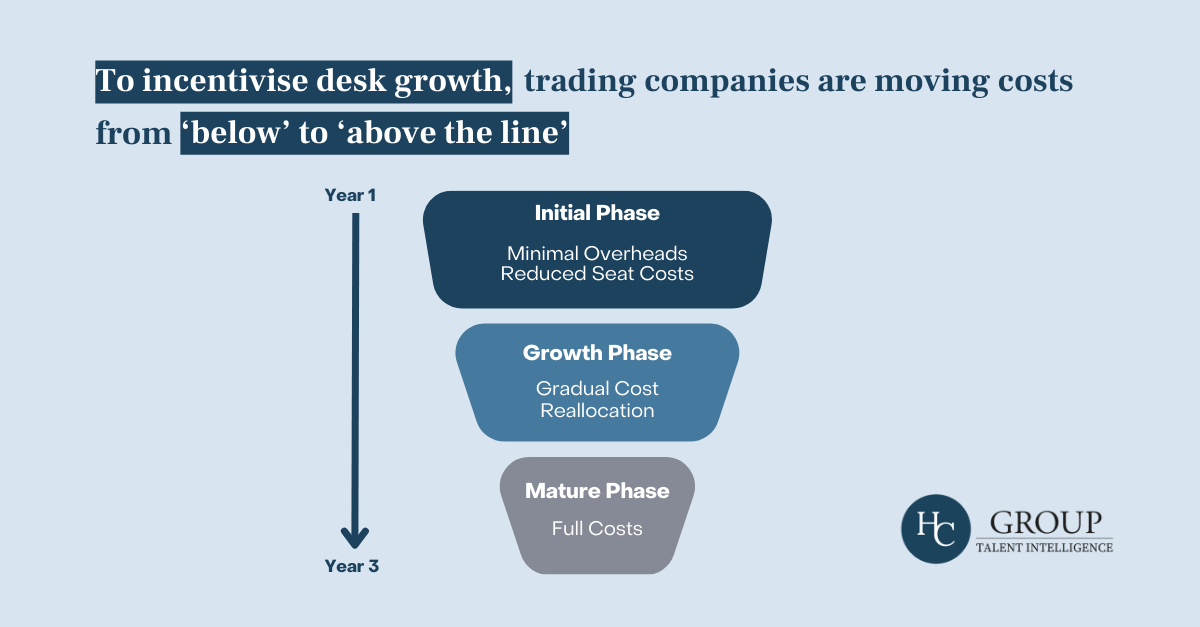

A particularly dynamic area of market development has been the establishment of new trading desks, especially in metals, where three major trading houses have established renewed presence. While these desks typically mirror existing compensation structures, organisations are implementing creative incentive structures (Chart 1) to drive competitive hiring. These include first earned arrangements, accelerated earn-outs, and strategic cost allocation adjustments.

Compensation Data and Advisory

By leveraging our specialised focus on the global energy and commodities sector, HC Group's Talent Intelligence team can deliver detailed insights into compensation structures, market context, and remuneration trends.

2. Moving Costs

To incentivise desk growth, a range of commodities businesses are increasingly moving costs from 'below' to 'above-the-line' until traders can generate sufficient P&L to cover increased seat costs (Chart 2).

This approach reflects a broader industry trend towards more sophisticated compensation structures that align individual incentives with organisational growth objectives.

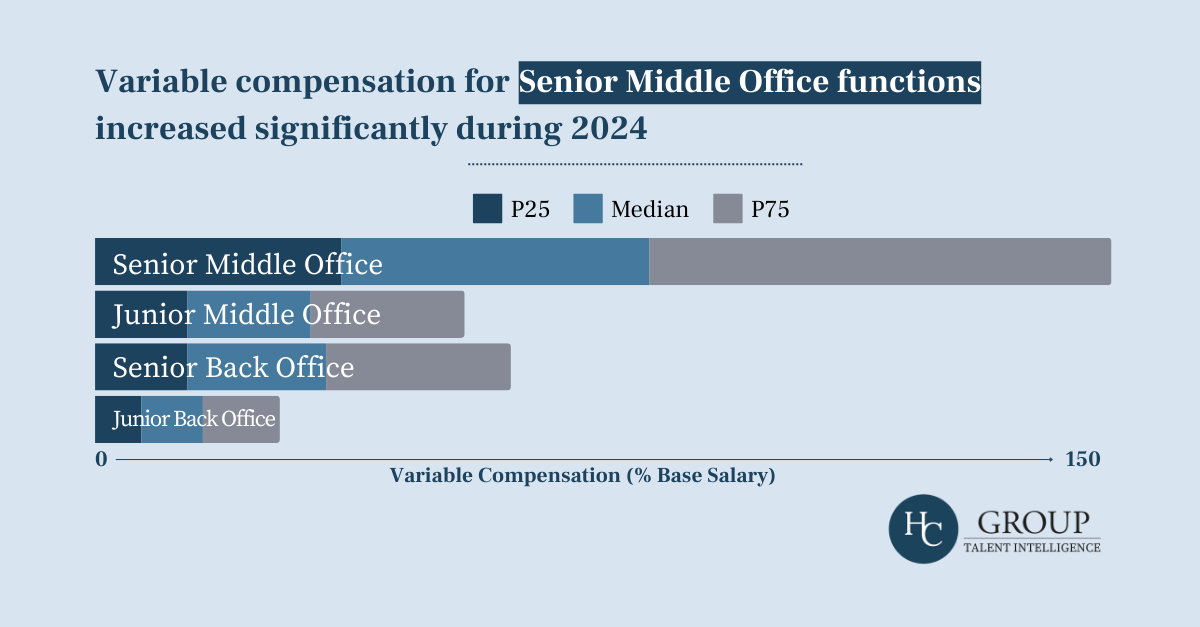

3. Support Functions Pay

The evolution of middle and back-office compensation represents one of the most significant transformations in recent years. These functions, traditionally viewed as cost centres, are increasingly recognised for their critical contribution to trading success.

Our analysis reveals a trend towards organisations increasingly sourcing their compensation from trading bonus pools rather than corporate or hybrid pools, reflecting their direct impact on front-office performance and P&L generation.

Among the standout trends of 2024 has been the rise of variable compensation for Senior Middle Office functions, as organisations tie remuneration increasingly to performance goals (Chart 3).

HC Group has also observed an increase in deferrals, partly due to improved compensation for middle and back-office roles, which has pushed more employees past the threshold for deferral eligibility. As a result, a larger portion of the workforce now has deferred compensation.

Looking ahead, HC Group anticipates that more companies will adopt the "growth on deferral" model, as employers aim to secure their future growth with a well-developed and committed talent base.

Thank you for reading this analysis from our Talent Intelligence Team.

To get more charts and insights delivered direct to your inbox, why not sign up to HC Group's Talent Intelligence Newsletter.